The Financial Times article ‘Cocoa market on the brink of big price surge’ was, without a doubt, a lever of optimism for farmers and a warning shot for the industry. As I finished reading the article, my first reaction was, "Who wrote this article?"—to gauge the veracity and accuracy of the information. The writer’s name was Monsieur Pierre Andurand, founder of his own investment fund1. His track record is impressive, with "cumulative returns of between 900% and 1,300% for investors since 2008."2 His credentials are as follows:

‘Pierre is a hedge fund manager specialized in commodities trading. He is also a VC investor in early stage technology companies (Mistral, H, Deep Mine…), and an entrepreneur (BlueGold, AC, GLORY). Academically, he holds 7 Masters in various areas (Theoretical Physics at Oxford, CS/ML at Columbia University, Astrophysics at Queen Mary, Finance at HEC, International Relations at LSE, Applied Maths at JHU, Applied Mathematics at INSA).

He has interests in macroeconomics, geopolitics, tech, science, AI, defence.’

I say ‘unfortunately’ because he is a private fund manager, so he might have a bullish bias towards cocoa if he holds positions in the market. It is not unethical to support your thesis; in fact, most Wall Street managers parade themselves every week on CNBC to express their outlook on companies and positions to ‘pump’ it up or down. As a farmer, I have nothing but full support for Mr. Andurand’s bullish outlook, but I would really like to know if his analysis is valid or speculative.

There are three main drivers that control world cocoa prices: Ivory Coast, Ghana, and the chocolate industry. To calibrate the cocoa outlook for the two main producing countries, one needs a bit of background in agriculture, which, as I have noticed, is often lacking in the financial world.

Mr. Andurand starts his article with the ‘structural supply-demand deficit’: ‘A supply-demand deficit occurs when the supply of a good, service, or resource is insufficient to meet the demand.’ This suggests there is currently not enough cocoa. Is there support for this thesis? To confirm this, we need to look at Ivory Coast and Ghana (which together account for more than half of the world’s production). Reuters recently published, “‘For Ghana's cocoa farmers, fertilizer is the vote winner in the looming election.”3 Ghana has been producing cocoa for decades, but they have old plantations that require synthetic fertilizer, such as N-P-K. Without it, yields are low. Most modern agriculture relies on fertilizers to achieve above-break-even yields. The article also mentions that past global calamities, such as the COVID-19 pandemic and the Russo-Ukrainian war, have burdened farmers, forcing many to reduce or eliminate fertilizer use. This shows that indeed, yields in cocoa are lower, and they are likely to remain low in the foreseeable future. The same scenario is highly probable for Ivory Coast as well.

In his second part of the article, Mr. Andurand quotes Forestero, a research company, to point out a new deficit of 160k to 200k tons. Although this further supports his bullish outlook—since less cocoa is bullish for prices—I cannot verify this information from Forestero as I cannot find anything online from this research company. If Mr. Andurand has the opportunity to read this article, I would greatly appreciate a link to this company or its forecast. Nevertheless, from Nasdaq News4 dated Nov. 24th, we can confirm that pod counts are low in the region.

Another part of the article exposes another insightful point: “Chocolate makers have been betting at their peril on a more sustained fall in prices.”5 This is quite alarming, as Mr. Andurand highlights it with the word ‘peril’, indicating that the industry has been hopeful about countering high prices with better harvest stockpiles. This is obviously not the outcome, so the chocolate industry will undoubtedly rush to compensate for the coming lower cocoa output. This will likely result in a surge in prices, and if we’re lucky, we might see the return of ‘panic’ in the market. Without a doubt, as Mr. Andurand points out: ‘This time from a depleted inventory base,’ a statement likely based on the falling ICE stockpile as seen in the graph:

The first panic wave in cocoa occurred in the first quarter of 2024. Since then, warehouses have indeed gone lower, reaching a critical level very fast. How will that affect the ICE cocoa regulation? I do not know, but if the Intercontinental Exchange (ICE) does not have the beans to support its contracts: can it come to a halt, or will "paper beans" become a new norm? It is an interesting question, particularly for those expecting delivery on the commodity for their processing facilities in a chocolate market that is ‘soaring’ and demanding more.

Furthermore, the article ventures into what Andurand calls ‘structural issues,’ such as the controversial EUDR regulations, which the EU seems unable to implement effectively. Despite their goodwill, these regulations add risk and uncertainty to the market, also much like the CSSD (Cocoa Swollen Shoot Disease or Virus). Neglected old plantations often become breeding grounds for pests and diseases. How bad is CSSD according to SwissDeCode 6:

Though Forestero says 67% are infected with CSSV, i cannot find confirmation of this data as of yet. As of 2023, ‘the disease is estimated to have a prevalence rate of over 30% in Ghana, as assessed in the ongoing third country-wide surveillance program’7

CSSV is already widespread in the two major producing countries, Ghana and Ivory Coast. Although it can now be more easily identified, there is no cure other than eradication of infected trees or plantations. Overextension of monocultures tends to create their own viruses, usually at the height of their production curve. Though somewhat pessimistic, Andurand expects an ‘impending collapse of production’ in the region, a bold and significant statement should it come to fruition. This affirmation is partly supported by Tropical Research Services, which declared that ‘production could halve over time due to the spread of CSSV,’ meaning a 50% reduction in output!

Andurand concludes his article by another more bullish factor: geographic constraints. Cocoa cannot be produced anywhere though some mad scientist think they can in labs, something we will have to see, yet until then, cocoa has a limited planting area. This represents a natural frontier for expansion. Establishing new plantations to offset the loss of African plantations would require at least four years—and provided they can navigate the constraints imposed by the EUDR regulations.

The tide might turn towards: how can we save current African plantations or how can we improve their current yields? This might be a new option for companies although I consider it to have a low likelihood of success based on current observations: the industry prefers hope or deceit8.

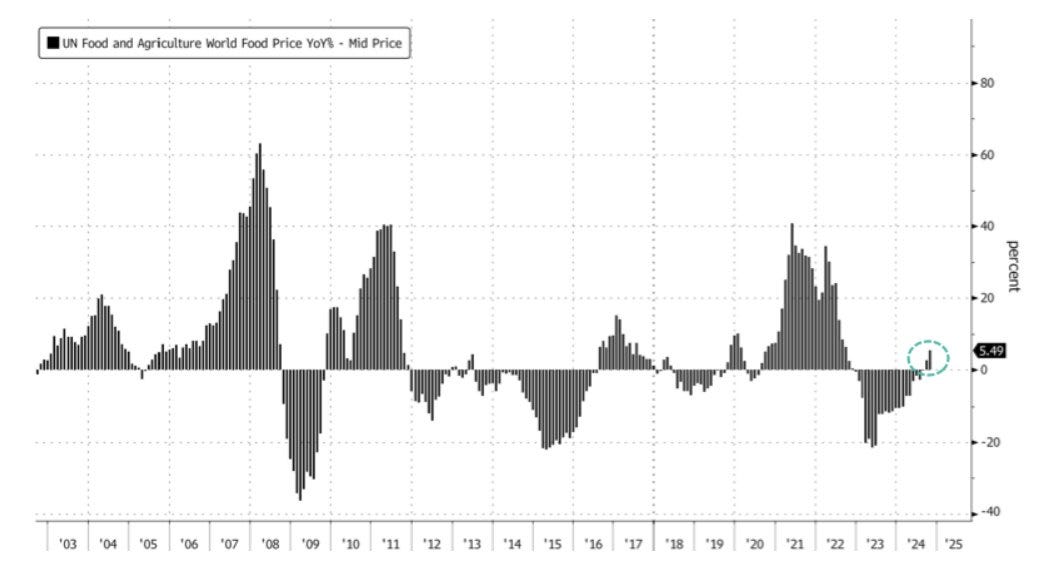

Pierre’s last observation on chocolate price elasticity was unknown until a year ago when cocoa prices surged. Market expectations leaned toward demand destruction; however, 2024 has demonstrated the opposite—price increases have had little impact on consumption. Add to that a global inflation on foods as seen on the graph pushing prices up on all categories.

This extremely bullish outlook will undoubtedly attract speculative participants, accelerating upward momentum in cocoa prices. Mr. Andurand’s outlook seems sound in my opinion, though perhaps somewhat conservative, as the weather factor could worsen cocoa crops, as seen in Ecuador’s 2024 drought, the third-largest cocoa producer in the world.

Most important, if Mr Pierre Andurand’s eyes and interest are set on cocoa then that tells you everything.

https://www.andurandcapital.com/

https://www.ft.com/content/2bcb2dfc-7d14-11e7-9108-edda0bcbc928

https://www.reuters.com/world/africa/ghanas-cocoa-farmers-fertiliser-is-vote-winner-looming-election-2024-12-03/

https://www.nasdaq.com/articles/cocoa-prices-surge-west-african-cocoa-crop-concerns-1

https://www.ft.com/content/d6d5a37c-27cd-4892-8dea-9dae7ec9c9fc

SwissDeCode https://swissdecode.com/dna-foil/cssd

https://pmc.ncbi.nlm.nih.gov/articles/PMC10819116/#:~:text=Cacao%20swollen%20shoot%20disease%20(CSSD,third%20country%2Dwide%20surveillance%20program.

https://ejencalada.substack.com/the-cocoa-bypass

Very informative dive into Andurand's article.

7 master's degrees? Anyways, with production so highly concentrated in two producing countries with ageing tree stocks, CSSV spread, record low stocks, and the usual weather concerns, cocoa prices have far more upside than downside potential. Andurand might be overstating the disease risk as the Ivory Coast and especially Ghana have in the past done some work to mitigate the spread of disease/replant trees but he's probably onto something.

Also interesting was the inflation-adjusted price of cocoa putting the current price at below 1980s' peak.